Creating a budget may seem like a daunting task, but it offers a great option for keeping your finances in order on a regular basis, planning ahead and knowing exactly where you stand at a glance. You’ll need your current bills, a spreadsheet or notebook and income information. We’ve provided a basic spreadsheet to get you started.

Decide On a Timeline

Most people plan a weekly budget because they are paid on a weekly basis. For the most part, it’s easiest to plan a budget if you do it around the days that you get paid. So, if you’re on a biweekly pay schedule, break your budget down into two week increments.

Incoming and Outgoing

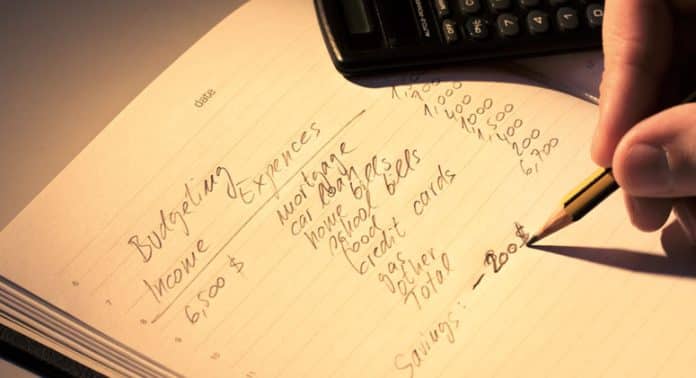

Start off by planning for your basic bills. You’ll get to saving for the future later on. For now you need to list your income and what is coming out of it. It’s best to list it so that your income pays for the coming week’s bills so that you always know you have enough to cover them.

Use a spreadsheet that can do the calculating for you, or a notebook that gives you enough space to list beginning balances, due dates, payments due, end balances, and interest. This way, you will be able to see your progress and exactly where you stand each step of the way.

As you list your bills, be realistic about your expenses. Include food, entertainment, gas, and any other expenses you have outside of monthly bills. You’ll get a better idea of where you are wasting money and where you can save it. If you aren’t quite certain how much you spend, estimate higher or keep your receipts all week to get a more accurate picture.

Above and Beyond

Once you have your monthly expenses outlined, you’ll be able to see how much money you have left at the end of the month. This is what you can start using on old debts, savings, and other investments.

~Here’s to Your Financial Health!