(FinancialHealth.net)

Smart Quiz: What is the Most Effective Way of Saving Money While Holiday Shopping?

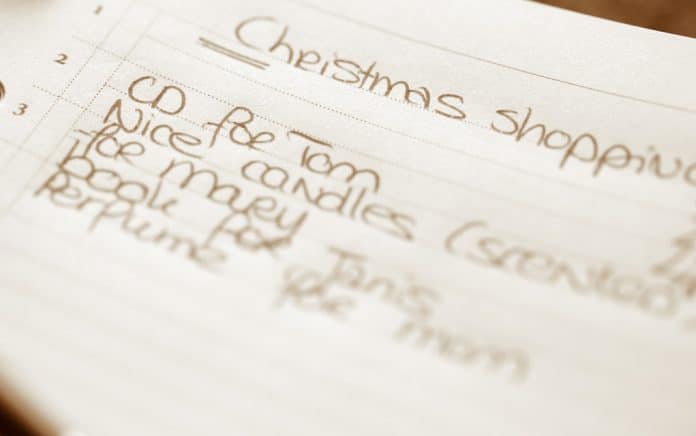

- Create A Shopping List

- Use Cash Only

- Avoid Gift Wrapping

- Avoid Self-Shopping

Answer: Create A Shopping List

Preparing for the holidays can be intimidating and exhausting or it can be peaceful and meaningful. Knowing you will avoid the regret of holiday debt after the holidays are over is one way of making them less stressful. This is especially important in the last week of shopping, where we tend to throw caution to the wind to wrap up our last minute meal and gift-giving needs.

Making payments the following January from winter holiday spending, is a sure way to resent and dread upcoming holidays in the future. Let’s change that! A shopping list is the perfect place to start.

A shopping list can be a simple tool to make the holidays more manageable, peaceful, and yes, even enjoyable. Let’s get started with some tips on getting the most out of a shopping list.

How to Make a List That Works:

- Assess your gift budget from the previous year’s holiday. Increase or lower the budget to reflect current finances and obligations.

- Make a list of the names of those you want to give a gift to. Using your total budget as a guide, estimate the amount of money you wish to spend on each gift.

- Try to decide as early as possible what you’d like to give to each person on your list and write that idea next to their name. Include a column for the approximate cost of the gift. This helps avoid being swayed by suggestive sells and upsells around the shopping mall.

How To Save on the Best Gifts

- Consider gifts that don’t require spending money. Some of the most memorable gifts are those of time spent together doing something special, or gifts that revolve around words from the heart. A letter to a friend detailing the ways you treasure their friendship can often be more meaningful than spending yet more hard earned money on a forgettable bottle of lotion.

- If you have a particular talent, a gift of something you created will be treasured for a lifetime.

- Keep an eye out for coupons and sales that can help you get what you need for your list. If it’s possible, buy items when you find them for the best price rather than waiting until the entire budget is saved up in a Christmas account or the change jar. Do some research to see what time of year is best for buying specific items, and save yourself some cash by making off season purchases.

- Above all, stick with the list. The temptation to deviate will always be there, but if you do it once, you’re more likely to do it multiple times and end up causing yourself more stress over the holidays.

- Begin saving for the upcoming holiday the day after it occurs. If you’re saving for Christmas, start putting money away on December 26th.Divide your total List Budget by 50. This gives you an extra two weeks to wrap gifts once you buy them. Once you divide the budget, you’ll see how much you need to put away each week to meet it. (Adjust as needed to account for bi-weekly or monthly income rather than weekly.)

However you prepare for the holidays, know that the sooner you start planning and preparing in thought and budget, the more you can focus on enjoying the holidays rather than stressing all the way through them.

Stick with a list and you’ll be thanking yourself come January, when you don’t have to pay off Christmas shopping bills. You can have a remarkable, unforgettable Christmas with minimal stress, just by starting with something as simple as a list!

~Here’s to Your Financial Health!

Copyright 2020, FinancialHealth.net