(FinancialHealth.net) – In March, Congress passed the CARES Act and people started receiving Economic Impact Payments. The rollout of the stimulus checks has been a little rocky, to put it mildly. And in addition to the problems getting the money to people, many rumors have swirled. It’s hard to know the truth from fiction.

Here are five of the most pervasive myths surrounding the CARES Act payments:

- Myth: You will get $1,200.

Truth: The $1,200 figure is the maximum amount for a single person who earns less than $75,000 a year. If you make more than that, the payment is going to be less.

- Myth: All dependents receive $500.

Truth: You’ll only get money for dependents who are under 17.

- Myth: You can keep the money for your deceased loved one.

Truth: The IRS said survivors must send the payments back.

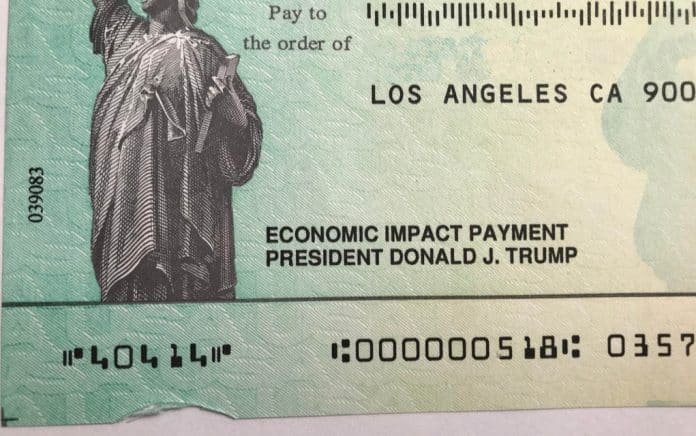

- Myth: President Donald Trump is the person giving you the money, and that’s why he signed the checks.

Truth: Congress actually allocated the funds, and the president signed the bill. Trump didn’t sign the checks; he added his signature to the memo line.

- Myth: Your 2020 tax refund will be less because of the stimulus payments.

Truth: Although Congress gave you an advanced refundable tax credit, it will never lower your refund. However, if the IRS didn’t give you what they owe you now, you may see an increase.

If you have any other questions about the stimulus payments, IRS.gov has a section that answers frequently asked questions. Also, you could speak to your accountant or financial adviser. Just remember, not everything you read on social media is true, so be sure to verify everything.

~Here’s to Your Financial Health!

Copyright 2020, FinancialHealth.net